As an investor and trader on the stock market, you would have an up to date information about your portfolio. A portfolio management software allows you to keep track of all the stocks you have invested and the current value of the portfolio. It keeps track of the stocks sold and the money made due to these transactions. We evaluate the best portfolio management software so that you can use the best software.

The MarketWatch Virtual Stock Exchange (VSE) Game allows users to create a portfolio Investment Portfolio An investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash and cash equivalents, and commodities. 9 of the Best Stocks for a Starter Portfolio Strong balance sheets, sustainable business models and reasonable valuations are part of the attraction. By Matt Whittaker, Contributor April 20, 2020. Set Up Your Free Portfolio Tracker Today At a glance, you'll see the current Zacks Rank for all stocks, ETFs and mutual funds included in your portfolio. You'll also know which rankings have gone.

Related:

My Stock Protfolio

It is an online Portfolio Management Software to track all your investments in stocks, mutual funds, and other securities. It is a complete solution by itself. It has an accurate record keeping feature which tracks every transaction like sell, buy, and dividends. You can make a better decision with its metrics reports.

Fund Manager

The software is a powerful portfolio management software available in various versions. The software can be used by an individual investor, professional trader or investment advisor. It tracks stocks, funds, options, bonds. It has good graphing facility and lot of reports. It calculates the capital gain for you to pay the proper taxes.

Share Sight

It is the best portfolio and tax reporting software for doing it yourself investors. It is an online service which keeps all your data in a centralized place, backed up and secure. You have the ability to access the data from anywhere. It has a nice interface to give access to the right people based on your needs.

Easy Life

Easy Life is a web-based finance management software for Indian customers. It covers all major investments covered in India. The application is available on the Mobile platform making it easy for the customer to use it. The data is maintained very securely with the help of GeoTrust. The data is not given to the third party for marketing.

Portfolio Tracking Software for Other Platforms

It is a pleasure to have the software on other platforms like Windows, Mac and mobile operating system platforms like IOS and Android. We will look at a couple of portfolio tracking software which works on the other platforms. This will help you if you have a particular platform you would like the software to run on.

Investoscope 3 for Mac

The software is a technical charting and portfolio tracking tool for individual investors which runs on the Mac platform. The software comes with a free version for 25 instruments and 50 transactions. It accurately records all transactions which help in reporting capital gains and losses for tax purposes.

JStock for Windows

The software is a free and open source tool to track your stock investment. It provides market information to make your investments decisions. You can create a stock watchlist from 34 Stock Exchanges around the world. You will get your net worth at any point of time, based on the latest share value.

Stock Market Eye – Most Popular Software

An easy to use portfolio management software which allows you to track all your investment and provide information to stay on the top of the market. You can make decisions on which stock to invest in technical analysis or charting. Watch lists can be created for particular sectors to understand how each sector performs.

How To Install Portfolio Tracking Software?

A windows based tracking software is installed as any other software on the Windows System. Download the software from the website or the link provided by the vendor. It is a good practice to read the installation guide before carrying out the actual installation. Get all the pre-requisites ready. Run the setup or install the program by double clicking the file. It will unzip the files and start the installation process. Answer the question which it asks and wait until the installation complete. Once you get the notification you can launch to see whether the application is running.

If you would like to track all your financial investments and manage the same then portfolio tracking software is the best tool for the same. It helps you keep track of all types of investment done by you with the latest prices. It allows doing solid research for future investments. You can use any of the software mentioned above to track your portfolio.

Related Posts

We get questions all the time on what is the best investment portfolio management software. Just the other day, someone read my post about how we track our net worth and asked me a really simple question – how do I track our stock investments?

The short answer is… well, I don't.

I check my investments once a month when I update the spreadsheet, and then I don't look at it. I think of our investment money in time capsules so even if something were to happen, I don't want to be tempted to respond.

I still read financial news from time to time, I like to be aware of what's happening so if there is a big change, I'm not caught off guard. But that's mostly for psychological reasons. I aim never to touch the investments outside of rebalancing and other bookkeeping.

That said, how I track our investments has changed over the years. If you asked this question five years ago, there was a clear separation between the best of the best and the rest. Almost every tool used Yodlee to scrape your account information, so their features were all very similar. The difference was in the interface and how good that startup's designers were.

Nowadays, the separation is much bigger. Companies are using these free tools as a lure for something bigger (usually wealth management) and that has benefited us all.

Until recently, I was using Google Finance for a quick snapshot of my investments. Google killed the portfolio feature, which is always a risk with a free tool, so now I rely on Personal Capital for that snapshot and big-picture planning.

So what's the best tool for tracking investments? I'll tell you what I liked about each of them.

What Is A Stock Portfolio Tracker

First, what are we talking about when we ask for the best stock portfolio trackers? We want a tool that can collect all of our investments and give us an understanding of how it is performing. Much like personal finance apps, we want it to be as seamless as possible and give us the ability to quickly analyze our holdings in a variety of ways.

As we list the best options below, we take into account the cost of the subscription (if there is one), as well as the speed and usability of the platform.

Morningstar Portfolio Manager

I haven't been using it for a long time but Morningstar Portfolio Manager is a tool that has been around for ages. It gives you the ability to track all of your investments in one place, keep track of price changes, pull in star ratings and other Morningstar data, while giving you insights and research from Morningstar. The portfolio manager does not link up your accounts so you have to enter your data manually (which may be a plus if you're concerned about the security risk).

It's available to the free membership. If you are a premium member, you get access to more of the tools – but tracking is free. I realize that's all pretty vague but I wanted to include it in the list because they still offer it and there's something to be said for longevity.

The premium service has a 14-day free trial too so you can check it out for free for two weeks to see if it works for you. Also, through our link, you get up to $100 off the Morningstar Premium subscription price if you decide to subscribe after the trial. We have a more detailed review of Morningstar Premium here.

StockRover Portfolio Management

StockRover offers the ability to link up your brokerage account and use its powerful analysis tools using your specific brokerage data. You will be able to analyze your portfolio against benchmarks and make key decisions using data, rather than gut feel or guesstimates. If you don't want to connect your brokerage, you can enter it manually or use a spreadsheet import too. They support thousands of accounts including Vanguard, Charles Schwab, Fidelity, TD Ameritrade, Wells Fargo, E*Trade, Chase, and more.

Once you've set it up, you can get daily, weekly, or monthly reports showing performance as well as analyze it for a variety of metrics such as risk adjusted return, volatility, beta, IRR, Sharpe Ratio and more. It's comprehensive and far more detailed than many others on this list. It really depends on how in-depth you wish to go.

StockRover has a free tier but you get more when you sign up for the paid services.

Personal Capital

If you want a quick snapshot of your overall finances, this tool gives it to you pretty quickly once you connect all of your data sources. While I would say you shouldn't be checking your finances every minute of every day (because it's a waste of time), Personal Capital just makes it so that the waste of time takes a lot less actual time.

Personal Capital is safe, it has an Investment Checkup tool to give you an idea if your investments are on track, and it has a pretty good retirement calculator too based on your data. If you need budgeting, it can track expenses as well but it's not as good at that as dedicated budgeting tools.

SigFig

SigFig was the first investment tracker I ever used. I signed up age ago because it was the only one that connected with E*Trade, TradeKing and Vanguard; the three brokers I used at the time. The interface is very simple, connecting accounts is seamless, and they've expanded the tools they offer since I first used it.

Until I moved to Personal Capital, I was using SigFig because it has beautiful charts:

A peek at some of the charts (my data is all messed up because it's 5+ years old!)

I stopped using SigFig over ten years ago and since then they've added some new features I haven't explored extensively. They've also added financial advisors who can help you manage existing investments, monitor your portfolio, and help you come up with a plan. They're not pushy though, I've never been called about a consultation.

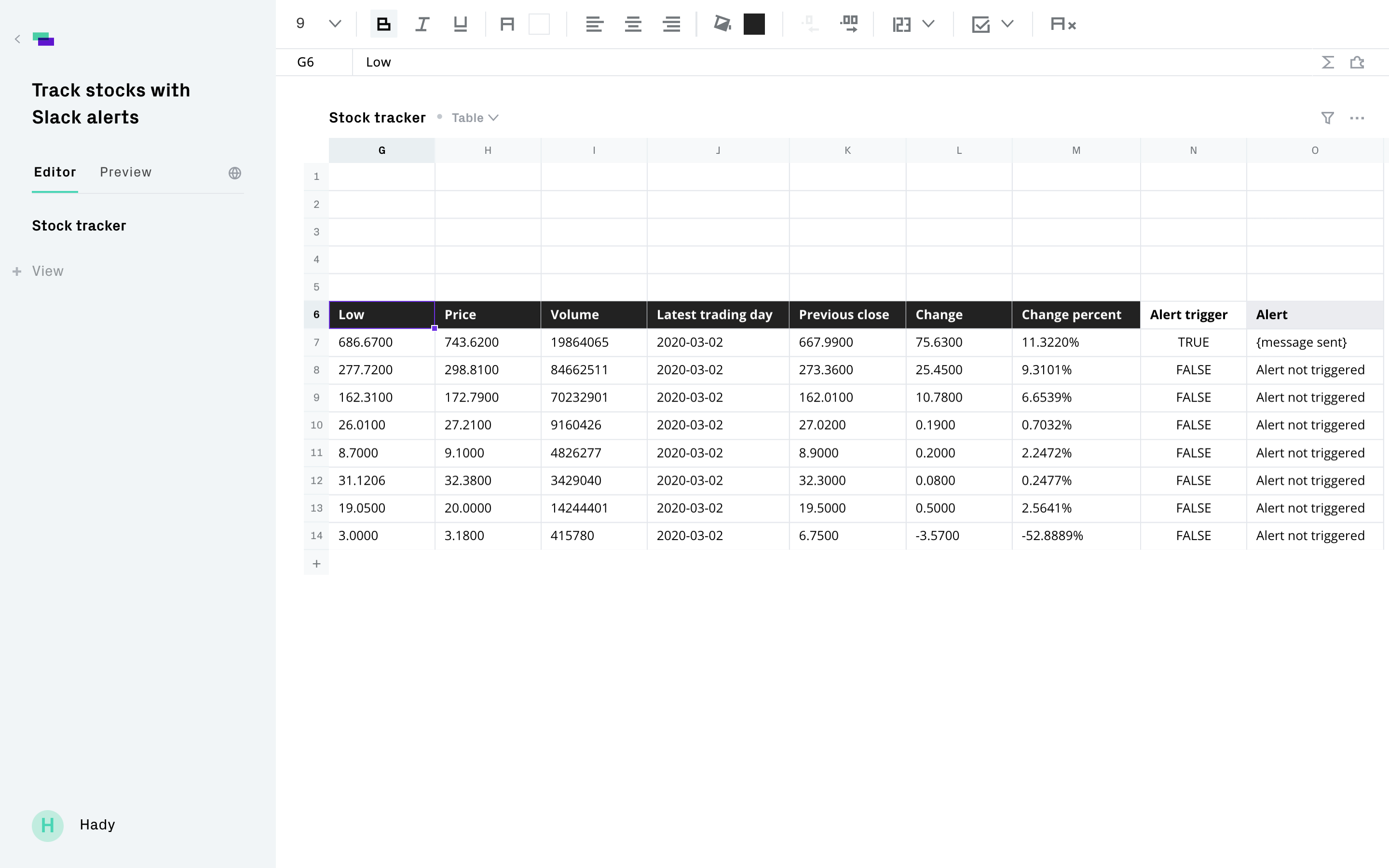

Google Sheets with Functions

If you like complete customization and your data secure on Google servers, you can create your own Google Sheet and pull data using a function provided by Google. The drawback is that you need to customize it and it'll be a very manual process, but you control it and it will always be free. You do run the risk of the GoogleFinance function changing underneath you but so far that hasn't happened in many years.

The core function to pull stock prices is simple:

=GoogleFinance('TICKER', 'price')

The Best Stock Portfolio Tracker For Mac Download

Where TICKER is the ticker symbol of the stock you're tracking. This data can be delayed up to 20 minutes.

If you want to check Amazon, you put this into a cell and it'll populate:

=GoogleFinance('AMZN', 'price')

The syntax of the function is available here. There is a huge menu of things you can do with the function, including show historical data, tables, etc. It's very solid and hasn't changed much, despite Google Finance being more tightly integrated into Google Search.

Google Finance

This was the first portfolio tracker I ever used.

I like Google Finance because the homepage gives you a handful of big stories (of which the headline alone gives you enough information) and then the portfolio tracking will pull in the major stories of your holdings.

I added my holdings as I acquired them, I removed them when I sold them, and I didn't use any of the cash tracking for those purchases and sales. What's nice about this set up is that it's easy so simple.

But they recently got rid of the Portfolio tracking features. You can still track companies, it just looks weird, you just won't be able to keep track of your basis.

I never used it to track my portfolio entirely, such as tracking cash inflows and outflows. I only used it to see how particular holdings were performing on a daily and overall level. Many of my individual stock holdings are now nearing their 10-year mark (acquired during the Great Recession) so it's all green across the board (and thus not particularly useful).

Final Verdict

You will be able to find a stock portfolio tracker from one of the options above.

If you want something relatively light and hands-off, Personal Capital can analyze your portfolio and help you understand whether you're on track to retire with the assets you need. Morningstar and Stock Rover exist for those who want more information and greater detail into their investment holdings.

And for the spreadsheet junkies, you always have Google Sheets or your own spreadsheets that you can customize to exactly what you want. It's all about what you hope to achieve and how much tinkering you need to do to get to it.

How do you track your investments?